2025 And 2025 Tax Brackets Comparison

2025 And 2025 Tax Brackets Comparison. Knowing your federal tax bracket is essential, as it determines your federal income tax. Married couples have the option to file separate tax returns, which is known as married filing.

Different tax rates have been provided for various categories of taxpayers and for different sources of income.

2025 Tax Brackets And Tax Rates Freddi Robina, It’s never a bad idea to plan ahead, especially when it comes to anything tax related. T he irs announced new income limits for seven tax brackets on thursday, providing some taxpayers breaks for 2025.

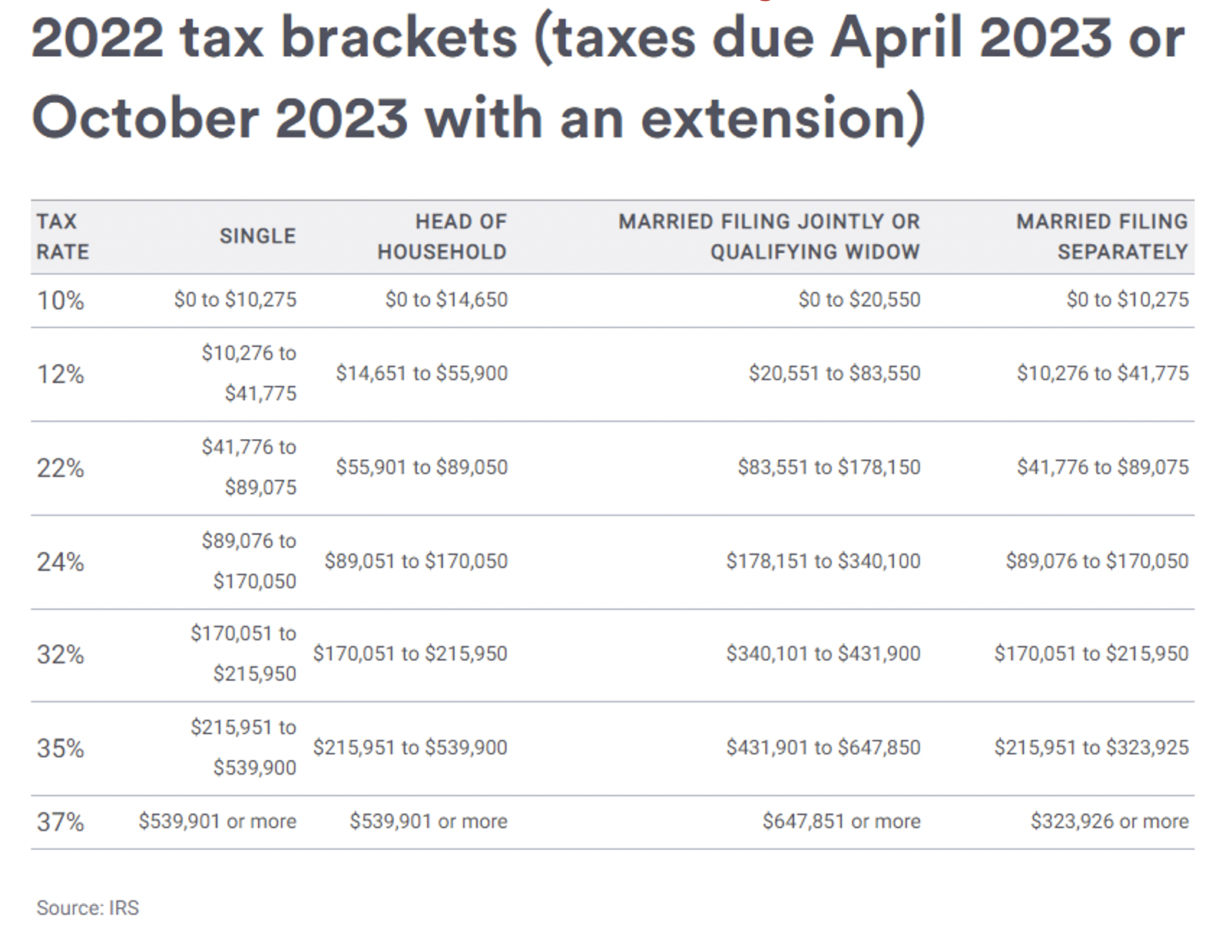

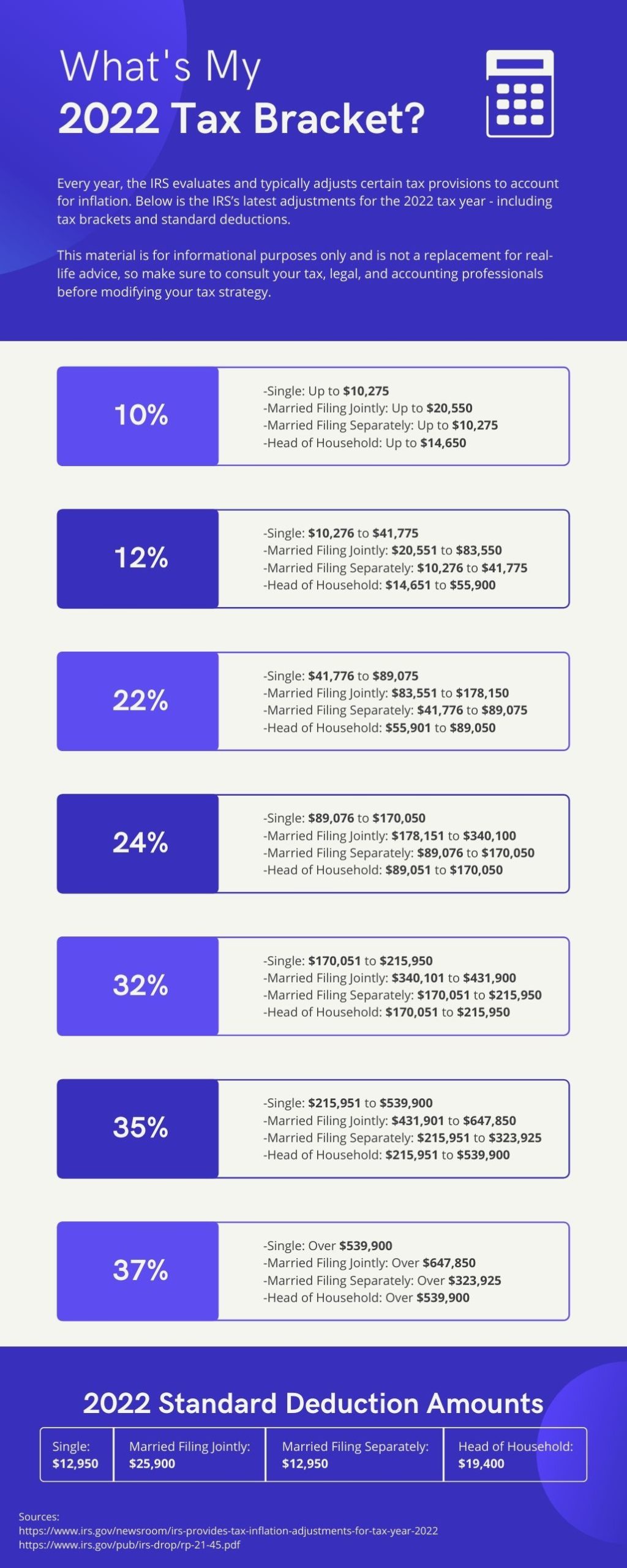

Compare 2025 Tax Brackets With Previous Years Mela Stormi, 2025 federal income tax rates. There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%.

2025 Tax Brackets Chart Printable Forms Free Online, About tax rates for australian residents. The 2025 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025.

2025 Tax Brackets Mfj Limits Brook Collete, There are seven federal tax brackets for tax year 2025. Last updated 21 february 2025.

2025 Tax Bracket Changes PBO Advisory Group, Wolters kluwer looks at the 2025 and 2025 tax brackets and standard deduction amounts. Australian residents tax rates 2010 to 2019.

What's My 2025 Tax Bracket (infographic) Delphi Advisers, LLC, Below, for comparison, are tax brackets and the standard deduction for income earned in 2025, which taxpayers will file with the irs in 2025, and for income. Also, check the updated tax slabs for individuals.

State Corporate Tax Rates and Brackets Tax Foundation, How much income tax you pay in each tax year depends on: See current federal tax brackets and rates based on your income and filing status.

2025 Vs 2025 Tax Brackets Latest News Update, The highest earners fall into the 37% range, while those. There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%.

2025 Tax Brakets Advise LLP, Different tax rates have been provided for various categories of taxpayers and for different sources of income. How much of your income is above your personal allowance.

11 MMajor Tax Changes for 2025 Pearson & Co. CPAs, Below, for comparison, are tax brackets and the standard deduction for income earned in 2025, which taxpayers will file with the irs in 2025, and for income. Meanwhile, single australians earning 167 per cent of the average wage in 2025 — or $166,274 — had their tax burden increase to 34 per cent, equivalent to $56,533.